International Taxation: Structuring Foreign Investment in the US

Jacob Stein, Esq. is the managing partner of Aliant, LLP. He specializes in international tax planning, creative business and private wealth transactions, and asset protection.

Subscribe to myLawCLEs All-Acces Pass...

Get this course, plus over 1,000+ of live webinars.

Learn More

MCLE Credit Information:

Select Your State Below to View CLE Credit Information

Tuition: $95

Training 5 or more people?

Sign-up for a law firm subscription plan and each attorney in the firm receives free access to all CLE Programs

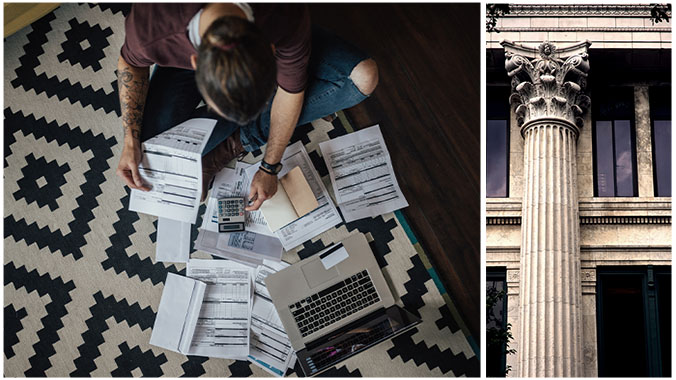

Program Summary

There has been a significant increase in foreign investment in the United States. Wealthy foreigners are seeking the safety of the U.S. financial and legal system, and the relative safety of the U.S. dollar. Many of these investors are surprised by the U.S. tax regime and pay significant U.S. income taxes. This program explores how the U.S. distinguishes between U.S. taxpayers and non-resident aliens, how it taxes non-resident aliens for income and transfer tax purposes, and how these foreign investors can plan to minimize taxation. The program aims to deliver very complex and technical subjects in a very approachable and easy to follow manner, and no prior tax experience is needed. You will learn how to spot traps for foreign investors, what structures are commonly used, and how to optimize.

Key topics to be discussed:

- U.S. taxpayers and non-resident aliens – permanent residence and substantial presence

- Different legal structures available to foreign investors and their pros and cons

- Gift and estate taxes applicable to foreigners and how to avoid them

- Income taxation of foreigners - FIRPTA, FDAP, branch profits tax and effective connected income

- Pre-immigration tax planning

Date: April 20, 2023

![]() Closed-captioning available

Closed-captioning available

Speakers

Jacob Stein | Aliant, LLP

Jacob Stein | Aliant, LLP

Jacob Stein, Esq. is the managing partner of Aliant, LLP. He specializes in international tax planning, creative business and private wealth transactions, and asset protection. Jacob received his law degree from the University of Southern California, and a Master of Laws in Taxation from Georgetown University. He is ranked in the Chambers and Partners High Net Worth Guide, holds an AV-rating from Martindale-Hubbell®, has been named a Super Lawyer® by the Los Angeles Magazine for over ten years, and is listed in the top 1% of ‘America’s Most Honored Professionals’ by the American Registry.

Over the course of his career, Jacob has represented family-owned businesses, successful startups and founders, officers and directors of Fortune 500 companies, politicians, high-profile entrepreneurs, celebrities, and some of the world’s most prominent families.

He is the author of books, dozens of scholarly articles and technical manuals. His most recent article, “Bulletproofing Assets,” was featured on the cover of the April 2022 issue of the Los Angeles Lawyer. Other recent published works include “Creative Planning Strategies Using Irrevocable Trusts” (Estate Planning Journal, 2020), “Tax Tips for Americans Doing Business in South America” (Journal of Taxation, 2019), and “Foreign Investment in U.S. Real Estate” (Journal of Taxation, 2019). Books authored by Jacob include A Lawyer’s Guide to Asset Protection Planning in California, Second Edition; International Joint Ventures – A Concise Guide for Attorneys & Business Owners; and Asset Protection for California Residents, Second Edition, the first and only book in print on asset protection planning specific to California residents that provides a sophisticated and in-depth look at the law in an accessible manner.

Jacob was an adjunct professor of taxation at the CSU, Northridge Graduate Tax Program for ten years. He lectures frequently to attorneys, CPAs and other professional groups, teaching over 50 seminars per year for state and local bar associations, estate planning councils, and international networking organizations. Jacob is an instructor with the California CPA Education Foundation, Thomson Reuters, the Rossdale Group, Spidell Publishing, and many more.

Agenda

I. U.S. taxpayers and non-resident aliens – permanent residence and substantial presence | 12:00pm – 12:15pm

II. Different legal structures available to foreign investors and their pros and cons | 12:15pm – 12:30pm

III. Gift and estate taxes applicable to foreigners and how to avoid them | 12:30pm – 12:40pm

IV. Income taxation of foreigners – FIRPTA, FDAP, branch profits tax and effective connected income | 12:40pm – 12:50pm

V. Pre-immigration tax planning | 12:50pm – 1:00pm

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

Register Now

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

More CLE Webinars

Trending CLE Webinars

![The Litigator’s Guide to Evidentiary Objections: When to hold them and how to avoid mistakes (Including 1hr of Ethics) [2024 Edition]](https://mylawcle.com/wp-content/uploads/2024/03/The-Litigators-Guide-to-Evidentiary-Objections-When-to-hold-them-and-how-to-avoid-mistakes-Including-1hr-of-Ethics-2024-Edition_myLawCLE.jpg)

Upcoming CLE Webinars

![The Litigator’s Guide to Evidentiary Objections: When to hold them and how to avoid mistakes (Including 1hr of Ethics) [2024 Edition]](https://mylawcle.com/wp-content/uploads/2024/03/The-Litigators-Guide-to-Evidentiary-Objections-When-to-hold-them-and-how-to-avoid-mistakes-Including-1hr-of-Ethics-2024-Edition_myLawCLE.jpg)

![Evidence 101 [Part 1]: Relevancy & company](https://mylawcle.com/wp-content/uploads/2024/07/Evidence-101_myLawCLE.jpg)