Making More from Contingent Fees

Jeremy consults for plaintiffs and plaintiff lawyers on settlement issues. He serves on the legal committees of the three national settlement planning associations, and previously served in the U.S. Treasury’s Office of Tax Policy.

Greg Maxwell, Esq., CFP®, advises plaintiff firms across the country on settlement planning, special needs planning, and income tax planning. He previously served as President of the Society of Settlement Planners.

Subscribe to myLawCLEs All-Acces Pass...

Get this course, plus over 1,000+ of live webinars.

Learn More

MCLE Credit Information:

Select Your State Below to View CLE Credit Information

Tuition: $95

Training 5 or more people?

Sign-up for a law firm subscription plan and each attorney in the firm receives free access to all CLE Programs

Program Summary

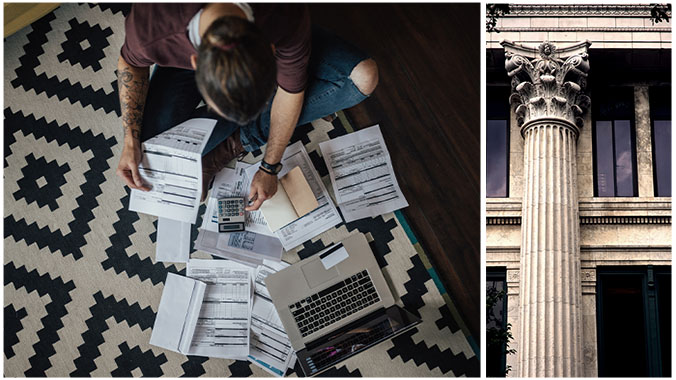

A contingent fee is always more valuable when the receipt of it is deferred. You pay tax later, you pay less tax now, and you defer tax on investment earnings. You can invest deferred fees using any number of arrangements. But no matter which arrangement is used, the basic steps to avoid immediate taxation are the same. This presentation will walk through the steps needed, why they’re important, and provide recommended language you can use.

Key topics to be discussed:

- The benefits and basis of deferred taxation

- Treatment of the various deferred options

- Steps needed so your deferral works

Date / Time: November 8, 2023

![]() Closed-captioning available

Closed-captioning available

Speakers

Jeremy Babener | Structured Consulting

Jeremy Babener | Structured Consulting

Jeremy consults for plaintiffs and plaintiff lawyers on settlement issues. He serves on the legal committees of the three national settlement planning associations, and previously served in the U.S. Treasury’s Office of Tax Policy.

Greg Maxwell | Amicus Settlement Planners

Greg Maxwell | Amicus Settlement Planners

Greg Maxwell, Esq., CFP®, advises plaintiff firms across the country on settlement planning, special needs planning, and income tax planning. He previously served as President of the Society of Settlement Planners.

Agenda

I. The benefits and basis of deferred taxation | 2:00pm – 2:20pm

II. Treatment of the various deferred options | 2:20pm – 2:40pm

III. Steps needed so your deferral works | 2:40pm – 3:00pm

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

Register Now

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

Preview

More CLE Webinars

Trending CLE Webinars

![The Litigator’s Guide to Evidentiary Objections: When to hold them and how to avoid mistakes (Including 1hr of Ethics) [2024 Edition]](https://mylawcle.com/wp-content/uploads/2024/03/The-Litigators-Guide-to-Evidentiary-Objections-When-to-hold-them-and-how-to-avoid-mistakes-Including-1hr-of-Ethics-2024-Edition_myLawCLE.jpg)

Upcoming CLE Webinars

![The Litigator’s Guide to Evidentiary Objections: When to hold them and how to avoid mistakes (Including 1hr of Ethics) [2024 Edition]](https://mylawcle.com/wp-content/uploads/2024/03/The-Litigators-Guide-to-Evidentiary-Objections-When-to-hold-them-and-how-to-avoid-mistakes-Including-1hr-of-Ethics-2024-Edition_myLawCLE.jpg)

![Evidence 101 [Part 1]: Relevancy & company](https://mylawcle.com/wp-content/uploads/2024/07/Evidence-101_myLawCLE.jpg)