Secure 2.0 – Review of Mandatory Retirement Plan Amendments

Adam Thomas is of counsel and a member of Best Best & Krieger’s Business and Employee Benefits & Executive Compensation practice groups.

Subscribe to myLawCLEs All-Acces Pass...

Get this course, plus over 1,000+ of live webinars.

Learn More

MCLE Credit Information:

Select Your State Below to View CLE Credit Information

Tuition: $195

Training 5 or more people?

Sign-up for a law firm subscription plan and each attorney in the firm receives free access to all CLE Programs

Program Summary

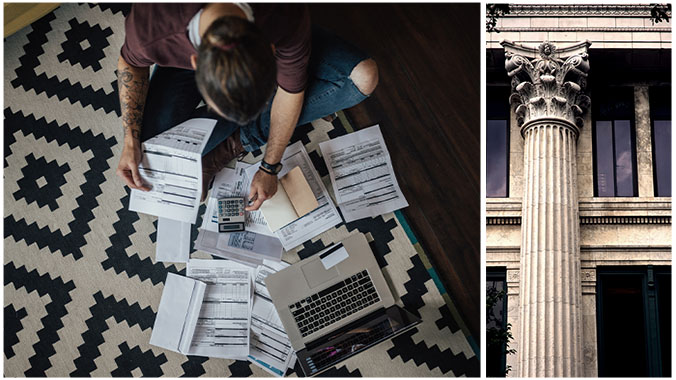

This CLE will cover the mandatory changes that most tax-qualified retirement plans must implement under the Setting Every Community Up for Retirement Enhancement (SECURE - passed in 2019), including additional changes made in SECURE 2.0 (passed in 2021)

Key topics to be discussed:

- Changes to Required Minimum Distribution Rules

- Changes to Catch-up Contribution Rules

- Automatic Enrollment Rules

- Long-Term, Part-Time Worker Rules

Date / Time: January 25, 2024

![]() Closed-captioning available

Closed-captioning available

Speakers

Adam Thomas | Best Best & Krieger LLP

Adam Thomas | Best Best & Krieger LLP

Adam Thomas is of counsel and a member of Best Best & Krieger’s Business and Employee Benefits & Executive Compensation practice groups. He has more than 10 years of experience in employee retirement benefits, health and welfare regulations, fiduciary compliance, labor and employment matters for private and public sector employers and collectively bargained, multi-employer trust funds.

Adam works with clients subject to ERISA, and non-ERISA clients including governmental and church retirement plans resolving complex legal issues under HIPAA, the Affordable Care Act, Medicare and Medicaid regulations, COBRA and DOL regulations. Adam also has a deep understanding of various IRS codes and regulations and has represented clients before the IRS through Voluntary Compliance Program.

Adam enjoys guiding non-profit business entities, and their leadership, through all phases of the non-profit lifecycle – design, implementation, tax exempt status registration, ongoing administration, fiduciary compliance, dissolution and liquidation of assets – all to ensure successful maintenance of federal and state tax-exempt status. Adam is passionate about mediating and helping resolve intra-leadership disagreements within nonprofit entities and builds on his experience and passion for conflict resolution.

Agenda

I. Changes to Required Minimum Distribution Rules | 12:00pm – 12:30pm

• Revised Required Beginning Date

• Reduced RMD Excise Tax Penalty

• Elimination of RMDs in Roth Accounts

• RMD Treatment for Surviving Spouses

II. Changes to Catch-up Contribution Rules | 12:30pm – 1:00pm

• Changes to 401(k) plan catch-up contribution limits

• Changes to 403(b) plan catch-up contribution limits

Break | 1:00pm – 1:10pm

III. Automatic Enrollment Rules | 1:10pm – 1:25pm

IV. Long-Term, Part-Time Worker Rules | 1:25pm – 1:40pm

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

Register Now

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

More CLE Webinars

Trending CLE Webinars

![The Litigator’s Guide to Evidentiary Objections: When to hold them and how to avoid mistakes (Including 1hr of Ethics) [2024 Edition]](https://mylawcle.com/wp-content/uploads/2024/03/The-Litigators-Guide-to-Evidentiary-Objections-When-to-hold-them-and-how-to-avoid-mistakes-Including-1hr-of-Ethics-2024-Edition_myLawCLE.jpg)

Upcoming CLE Webinars

![The Litigator’s Guide to Evidentiary Objections: When to hold them and how to avoid mistakes (Including 1hr of Ethics) [2024 Edition]](https://mylawcle.com/wp-content/uploads/2024/03/The-Litigators-Guide-to-Evidentiary-Objections-When-to-hold-them-and-how-to-avoid-mistakes-Including-1hr-of-Ethics-2024-Edition_myLawCLE.jpg)

![Evidence 101 [Part 1]: Relevancy & company](https://mylawcle.com/wp-content/uploads/2024/07/Evidence-101_myLawCLE.jpg)