3rd Annual Tax Rep Summit [3-Day Event] (Day-2)

Attorney Eric L. Green is a practicing tax attorney, author, speaker, and coach. He founded Tax Rep LLC which runs the popular tax representation practice-growth training and coaching program Tax Rep Network.

Roger Nemeth is the founder of Audit Detective (Tax Help Software). Prior to creating Tax Help Software Roger managed a large tax franchise in Atlanta that employed 15 enrolled agents.

Subscribe to myLawCLEs All-Access Pass...

Get this course, plus over 1,000+ of live webinars.

Learn More

MCLE Credit Information:

Select Your State Below to View CLE Credit Information

Tuition: $0.00

Training 5 or more people?

Sign-up for a law firm subscription plan and each attorney in the firm receives free access to all CLE Programs

Program Summary

Before the pandemic started, taxpayers who could not pay their IRS debt and that were in the IRS Collections Division inventory numbered over 15 million, with another 10 million identified non-filers. Now that we are emerging from the pandemic, that number will skyrocket due to those affected by long-term unemployment, unpaid rent backlogs, and insane hospital bills. Tax professionals who know how to work out payment agreements between the IRS and these taxpayers are in more demand than ever before.

This special IRS Representation Summit is being put on by Eric Green (Tax Rep Network) and Roger Nemeth (Tax Help Software) and is designed as a multi-day workshop that will walk you through not only the IRS Rep process but the forms, and cover case studies and marketing techniques to help you build this lucrative practice area.

Your instructors are Eric Green and Roger Nemeth. Eric is a nationally-recognized tax attorney and popular speaker and author who has helped thousands of accountants start and grow successful tax representation practices. Attorney Green’s offer acceptance rate is 93 percent, and he will share his best-in-class methods. Full bio below.

Roger Nemeth is the founder of Audit Detective (Tax Help Software). Prior to creating Tax Help Software Roger managed a large tax franchise in Atlanta that employed 15 enrolled agents. Realizing the need for transcripts and transcripts information Roger created a product to do just that and from that point Audit Detective began and has now evolved into an extensive analysis of tax data going back to 1990. Our users have downloaded over 300,000,000 IRS transcripts and processed over 1,000,000 Reports.

Date / Time: December 13, 2023

Date / Time: December 14, 2023

Date / Time: December 15, 2023

![]() Closed-captioning available

Closed-captioning available

Speakers

Eric L. Green| Green & Sklarz LLC.

Eric L. Green| Green & Sklarz LLC.

Attorney Eric L. Green is a practicing tax attorney, author, speaker, and coach. He founded Tax Rep LLC which runs the popular tax representation practice-growth training and coaching program Tax Rep Network. Through his role as the primary instructor and coach at Tax Rep Network, he has helped hundreds of accountants start and grow successful tax representation practices.

Eric is a partner and founder of law firm Green & Sklarz LLP, which is based in New Haven, Connecticut, where his focus is taxpayer representation before the IRS, Department of Justice Tax Division and state departments of revenue. Prior to becoming an attorney, Eric served as a senior tax consultant for national and international accounting firms, including KPMG and Deloitte & Touche.

Eric developed a national reputation by building a remarkable record of negotiating favorable settlements in thousands of civil cases against government agencies and has also been able to convince government agents and attorneys to forgo criminal charges and civilly resolve many cases.

Eric is a Fellow of the American College of Tax Counsel, an organization in which membership is an honor reserved for those at the top of their chosen profession. The College’s members, called “Fellows,” are recognized for their extraordinary accomplishments and professional achievements and for their dedication to improving the practice of tax law. Fellows must be nominated by their peers for this honor.

Eric is a frequent lecturer at American Bar Association Tax Section conferences, accounting conferences, and state Enrolled Agent conferences. He served as adjunct faculty at the University of Connecticut School of Law where he taught law students to handle taxpayer representation matters in the low income taxpayer clinic. He is often quoted in the Wall Street Journal, USA Today, CreditCard.com and Consumer Reports Financial News.

Eric is the author of the Accountant’s Guide to IRS Collection, the Accountant’s Guide to Resolving Tax Debts, a contributing author on Advocating for Low Income Taxpayers: A Clinical Studies Casebook and was interviewed for the book Stop Hiding from the IRS: The Insider’s Guide to Solving Your Tax Debts Once and For All.

Attorney Green received his Bachelor of Business Administration degree in Accounting with a minor in International Business from Hofstra University and is an honors graduate from New England School of Law. He earned a Masters of Laws in Taxation from Boston University School of Law.

Roger Nemeth | Tax Help Software

Roger Nemeth | Tax Help Software

Roger Nemeth is the founder of Audit Detective (Tax Help Software). Prior to creating Tax Help Software Roger managed a large tax franchise in Atlanta that employed 15 enrolled agents. Realizing the need for transcripts and transcripts information Roger created a product to do just that and from that point Audit Detective began and has now evolved into an extensive analysis of tax data going back to 1990. Our users have downloaded over 300,000,000 IRS transcripts and processed over 1,000,000 Reports.

Agenda

Day 1 – Wednesday, December 13

I. Everything You Missed This Year in 60 Minutes | 8:30am – 9:30am

II. The Exam Interview | 9:30am – 10:30am

Break | 10:30am – 10:45am

III. The IRC and IRM Sections You Must Know | 10:45am – 12:00pm

Lunch | 12:00pm – 1:00pm

IV. How to Challenge the Mod A Calculation | 1:00pm – 2:00pm

V. The Social Security Levy | 2:00pm – 3:00pm

Break | 3:00pm – 3:15pm

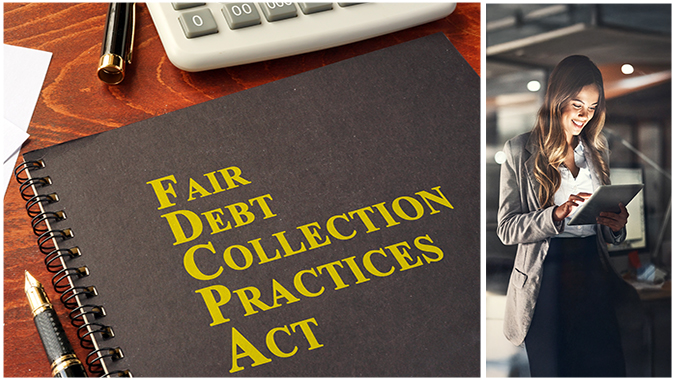

VI. The Tax Rep Cases You Need to Know | 3:15pm – 5:00pm

Day 2 – Thursday, December 14

I. What’s Reasonable? Reasonable Compensation and Challenge by the IRS | 8:30am – 9:30am

II. How to Draft Your Reasonable Cause Statement for Penalty Abatement | 9:30am – 10:30am

Break | 10:30am – 10:45am

III. Discharging Tax Debts in Bankruptcy | 10:45am – 12:00pm

Lunch | 12:00pm – 1:00pm

IV. How to Complete the 433: Line Item by Line Item Analysis | 1:00pm – 3:00pm

Break | 3:00pm – 3:15pm

V. Criminal Tax Investigations | 3:15pm – 5:00pm

Day 3 – Friday, December 15

I. Options for Practice Tools | 8:30am – 9:45am

Break | 9:45am – 10:00am

II. Crazy Tax Cases | 10:00am – 11:00am

III. Platinum Panel – Practice Tips from the Experts | 11:00am – 12:00pm

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

Register Now

#1 CLE Access Program

- Over 1,000 Live CLE Webinars each year

- All CLE webinars broadcasted in last 12 months

- Programs covering over 35 practice areas

- Hot topics & changes in the law

- All formats: Live, Replay, and On-demand

- Accreditation in every state

Access every CLE webinar,

every format, all year long!

myLawCLE All-Access Pass

only $395 yearly

More CLE Webinars

Trending CLE Webinars

Upcoming CLE Webinars

![The Cloud and GenAI: Security, Audits, and the Related Ethical and Legal Responsibilities [Part 3]](https://mylawcle.com/wp-content/uploads/2024/10/The-Cloud-and-GenAI_myLawCLE.jpg)

![4th Annual Tax Rep Summit [4-Day Event]](https://mylawcle.com/wp-content/uploads/2024/09/4th-Annual-Tax-Rep-Summit_myLawCLE.jpg)